Youll have to apply online before you try to get a contractors license. Contractors excise tax.

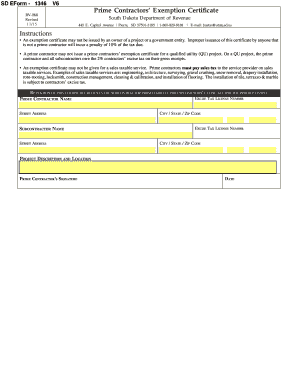

2021 Sd 1346 Formerly Rv 068 Fill Online Printable Fillable Blank Pdffiller

The class D license fee is 100.

. However the buyer will have to pay taxes on the car as if its total cost is 12000. In some of the cities in South Dakota you may be asked to pay an extra annual fee. A license card will be issued once the license is approved.

You will need to pay 300 for Class B and 225 for Class C. The license fee in South Dakota varies depending on the class of license you apply for. Types of Alcohol Licenses.

Find information on which cigarettes are allowed to be sold in South Dakota. The South Dakota Department of Revenue requires all contractors who enter into a contract for construction services to carry a South Dakota contractors excise tax license. For all general contracting companies operating in South Dakota you will have to obtain a business and occupational license and register for tax identification numbers.

This is the case even when the buyers out-of-pocket cost for the purchase is 10800. Do not have a sales tax license. South Dakota doesnt require many contractors to carry a contracting license but its serious about its tax excise requirements.

More information about the Contractors Excise License is available from the Department of. This includes repair or remodeling of existing real property or the construction of a new project. This includes contractors who repair or remodel existing real.

Sales Use and Contractors Excise Tax licenses. Artisan Distiller Malt Beverage Manufacturer Carrier Liquor Common Carrier Microcidery Direct. Address change to the South Dakota Business Tax Division.

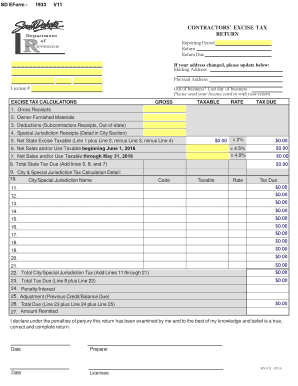

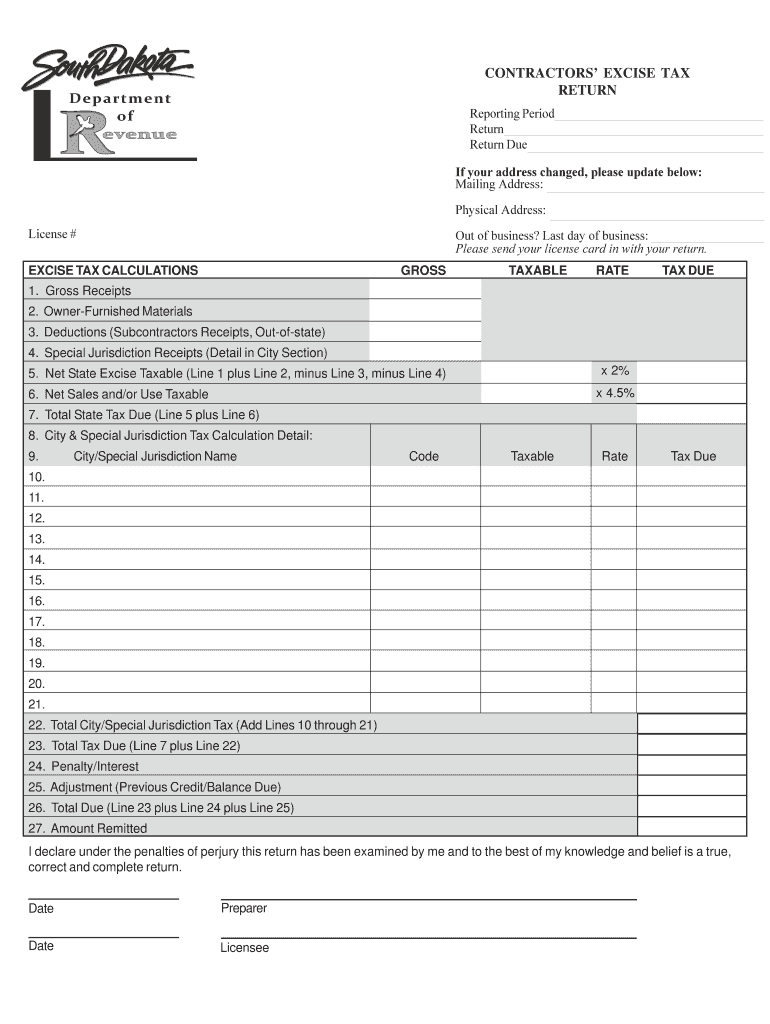

Please use the box provided on the return to correct your address or notify the South Dakota Business Tax Division. Contractors Excise Tax is an essential part of the South Dakota tax structure and the more you know about the tax the easier it is to comply with it. Any person entering into a contract for construction services must have a South Dakota contractors excise tax license.

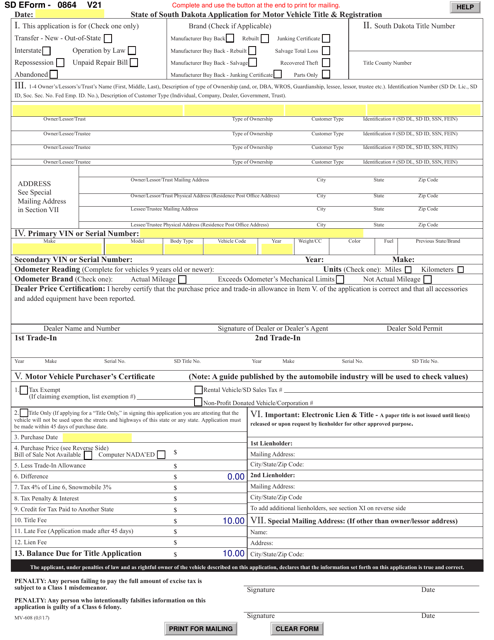

MV-609 South Dakota Department of Revenue Division of Motor Vehicles 445 E. Corporations will also be required to. CONTRACTORS EXCISE TAX RETURN License.

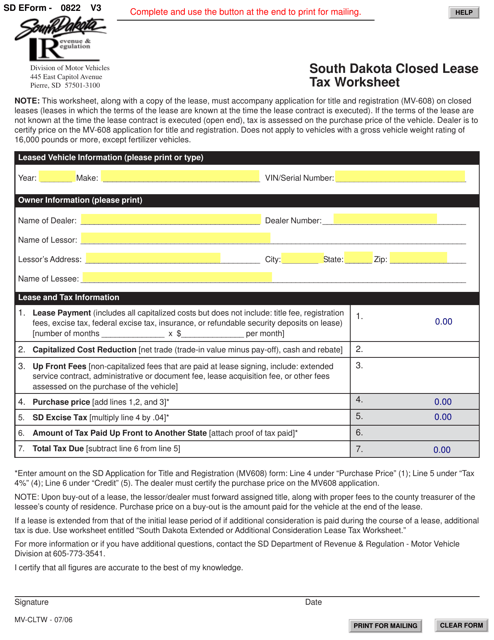

Capitol Avenue Pierre SD 57501-3185 605-773-3541 Fax 605-773-2550 Revised 0709 This form is to be used when claiming an exemption from the South Dakota. For starters South Dakota charges a 4 excise tax. For help please call the Special Taxes Division.

Contractor Excise License. Capitol Avenue Pierre SD 57501-3185 605-773-3541 Fax 605-773-2550 Revised 0616 This form is to be used when claiming an exemption from the South Dakota. Like in Montana maybe RVers chose South Dakota RV registration for tax reasons.

To cancel your tax license check the out-of-business box on the return and enter. Please call the Department at 1-800-829-9188 if you have not reported tax due. Total State Tax Due Add Lines 52 and 62 1.

If only your mailing address changes and the business location remains the same. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6 South Dakota has 142 special sales tax jurisdictions with local sales taxes in addition to the. 6 January 2022 Contractors Excise Tax Guide South Dakota Department of Revenue Definitions and General Information cont Project Examples Owner-Furnished Material The prime contractor owes contractors excise tax on the value of material furnished by the owner of the construction project except for qualified utility projects.

South Dakotas unemployment insurance tax varies from 0 to 95 of the first 15000 in wages paid to each employee during a calendar year. 2 December 2021 South Dakota Department of Revenue License Requirements for Sales Use Contractors Excise Tax Contact Us If you have any questions please contact the South Dakota Department of Revenue. Construction services include the construction building installation and remodeling of real property.

In general a Class A license costs 450. However there are a few differences to consider. Thus a 12000 car may have a 1200 cash rebate.

Learn More About Cigarette Tobacco. South Dakotas taxes on vehicle purchases are applied to the sale price before rebates or incentives. 1-800-829-9188 Business Tax Division Email.

If you have any questions regarding the lottery please contact South Dakota Lottery at 1-605-773-5770. South Dakota is a member of the Streamlined Sales and Use Tax Agreement an interstate consortium with the goal of making compliance with sales taxes as simple. You may also have to adhere to South Dakotas 2 Excise Tax on the gross receipts of your contracting services.

Snow removal lawn care or consulting service. Order stamps pay excise tax find retailer information and report sales of tobacco products to businesses located within special jurisdictions. That said this RV tax is still much lower than in most states.

This application allows for the renewal of the following alcohol and lottery licenses. Enter the Total Tax this is line 2 on your last non-zero South Dakota Tax Return. Contractors excise tax Municipal tax 911 emergency.

In addition to education or experience your local government will probably require that you pass a test based on your. South Dakotas motor vehicle excise tax which is 4 percent applies to all motor vehicles registered in the state of South Dakota. Fixture to real property must have a South Dakota contractors excise tax license.

A new license card with the new address will be mailed to you. Include receipts for projects located outside of South Dakota or any other non-taxable transactions that were included in Line 1. Enter the tax due line 23 from your last non-zero return.

Contractors excise tax is imposed on the gross receipts of all prime contractors engaged in. MV-609 South Dakota Department of Revenue Division of Motor Vehicles 445 E. Other business taxes include.

If only your mailing address changes and the business location remains the same note Mailing Address Change Only. The RV registration fee is also very reasonable. Excise Tax Calculation Gross Receipts Do NOT deduct out any tax before.

This booklet has been designed to assist you in applying for a South Dakota Contractors Excise Tax license and in remitting the tax to the Department of Revenue. South Dakota requires contractors to pay 2 of gross receipts from construction projects as an excise tax.

Sd Form 0864 Mv 608 Download Fillable Pdf Or Fill Online Application For Motor Vehicle Title Registration South Dakota Templateroller

Sd Form 0822 Mv Cltw Download Fillable Pdf Or Fill Online South Dakota Closed Lease Tax Worksheet South Dakota Templateroller

Sd Excise Tax Form Fill Online Printable Fillable Blank Pdffiller

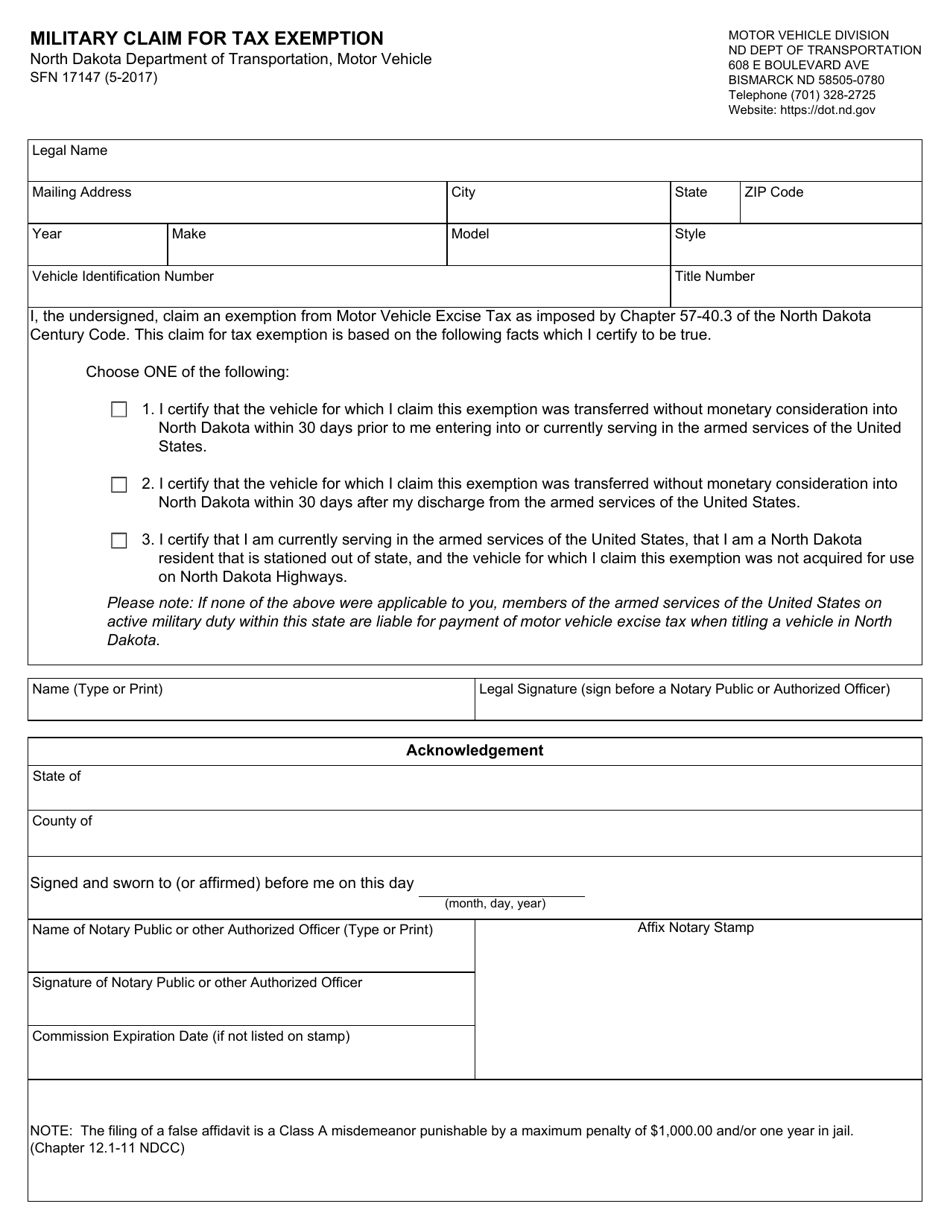

Form Sfn17147 Download Fillable Pdf Or Fill Online Military Claim For Tax Exemption North Dakota Templateroller

Contractor S Excise Tax South Dakota Department Of Revenue

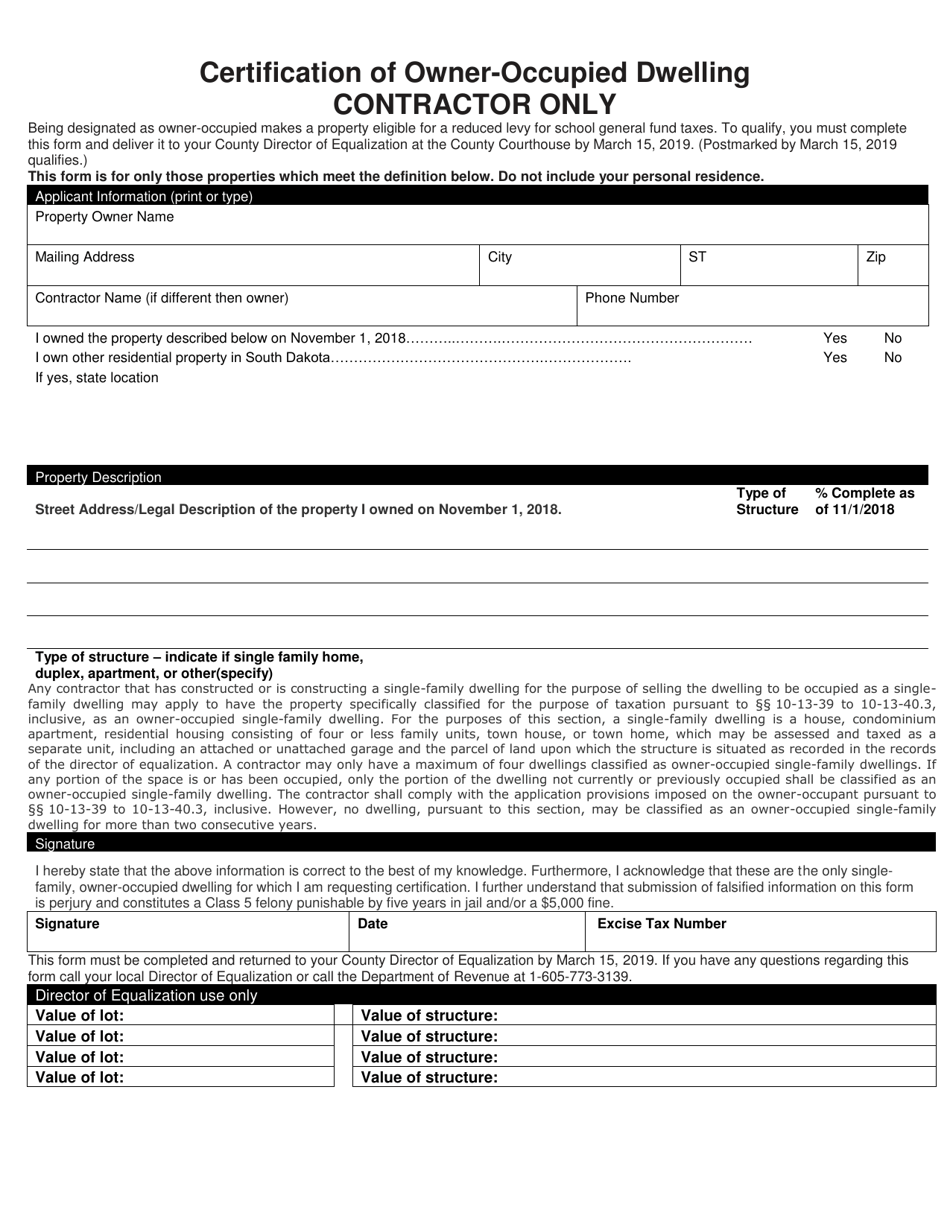

South Dakota Certification Of Owner Occupied Dwelling Contractor Only Download Printable Pdf Templateroller

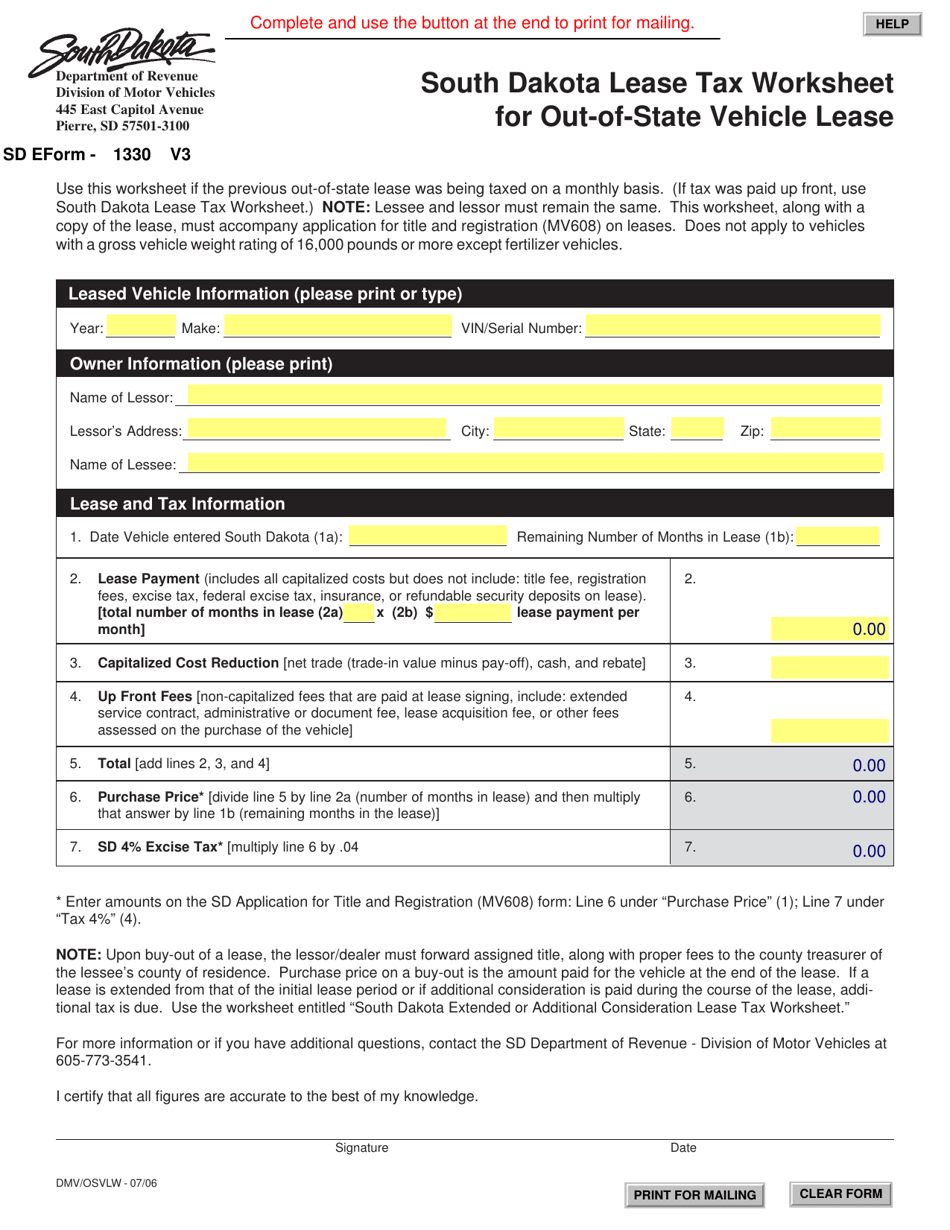

Sd Form 1330 Download Fillable Pdf Or Fill Online South Dakota Lease Tax Worksheet For Out Of State Vehicle Lease South Dakota Templateroller

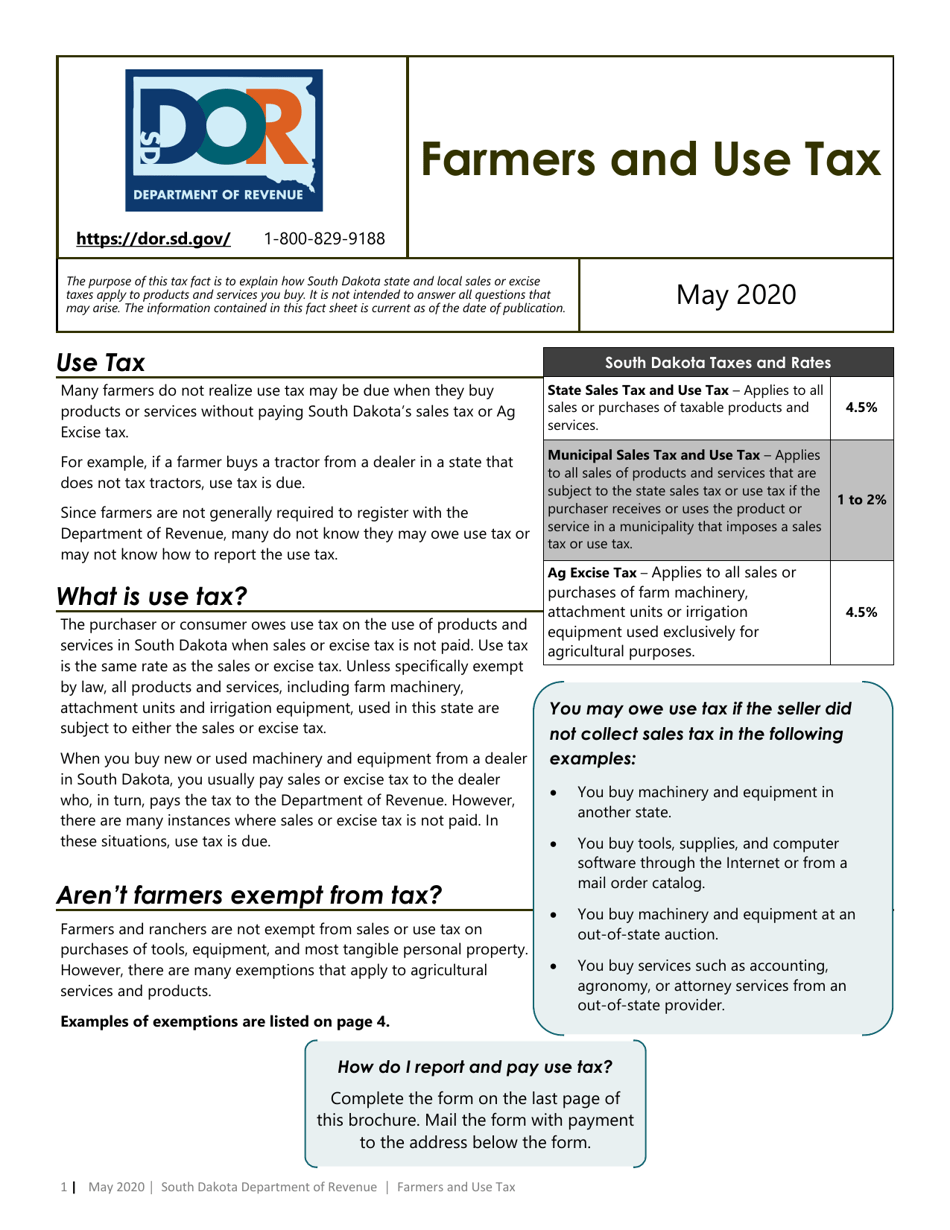

South Dakota Farmer S Use Tax Form Download Printable Pdf Templateroller

Sd Contractor S Excise Tax Return Formerly Rv 011 Fill Out Tax Template Online Us Legal Forms

Contractors39 Bexcise Tax Returnb State Of South Dakota State Sd Fill Out And Sign Printable Pdf Template Signnow

How To Register For A Sales Tax Permit In South Dakota Taxvalet